When you need small business financing, leveraging your inventory could be a viable option. This kind of funding allows you to purchase much-needed inventory by using the items you intend to buy as collateral.

Inventory small business loans can be convenient if you need to unlock capital tied up in inventory, or if you’re struggling to meet customer demand. But how do you get inventory financing, and what are the pros and cons? This guide explains everything you need to know about how inventory financing works and how to use it to your business’s advantage.

What is Inventory Financing?

Inventory financing is a type of short-term small business funding that has one purpose: to help you buy inventory for your business.

Small businesses turn to inventory financing to:

- Cover short-term cash shortages

- Prepare and stockpile inventory for the busy season

- Expand product lines

- Unlock capital tied up in inventory

- Secure upfront cash to keep up with customer demand (and increase sales)

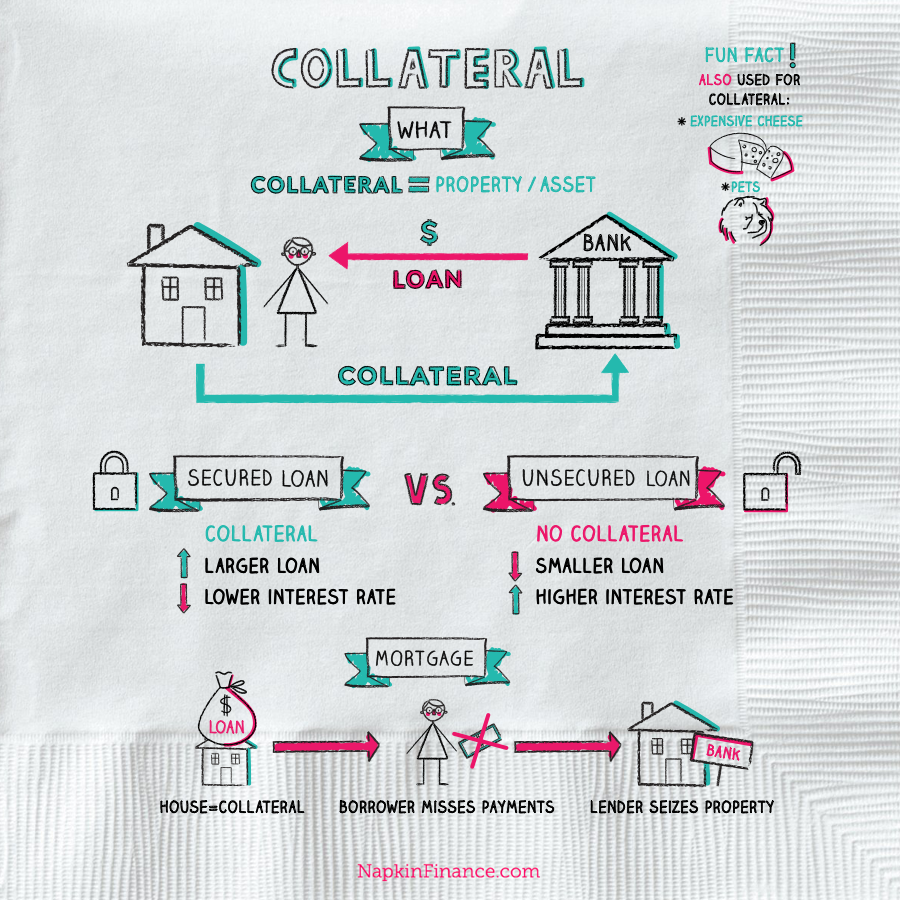

With other small business loans, you may need to offer property or assets as collateral. Your lender uses this collateral as security in case you default on the loan.

An inventory financing loan doesn’t require you to offer a house, car, or equipment as collateral. Instead, the inventory you plan to purchase secures the loan. If you’re unable to make the payments, the lender can seize the stock you haven’t sold to recoup the outstanding amount you owe on the loan.

Inventory Financing Rates and Terms

Interest rates, fees, and repayment terms for inventory financing can vary among different lenders and funding companies. Generally, however, you can expect terms in this range when seeking out an inventory loan:

- Borrowing amounts: Up to 100% of the inventory’s liquidation value (although lenders usually finance somewhere between 50% to 80%)

- Repayment terms: Up to 36 months, but three to 12 months is most common

- Annual percentage rate (APR): 4% to 99%, depending on the lender, loan terms, and creditworthiness

- Fees: Lenders may require an appraisal fee to determine the inventory’s value, origination fees, or prepayment penalties

The good news is numerous lenders offer inventory financing, either in the form of a business term loan or business line of credit. The more lending options you compare, the better your odds of finding an inventory loan at the best available terms for your situation.

How Does Inventory Financing Work?

There are two ways inventory financing can work. You can either get a term loan from a bank or online lender to purchase inventory or you can get a line of credit.

The difference is that a term loan provides the full amount of money upfront, which you typically pay back in fixed monthly payments over a predetermined period. A line of credit can be drawn against as needed to purchase inventory. Unlike a term loan, you only pay interest on the portion of the credit line you use. And, assuming the line of credit is “revolving,” once you pay off what you owe, your credit limit returns to the initial approved amount.

Here’s an example of how it might work. Say that you need to purchase $500,000 in inventory to prepare your business for your peak season. You apply for financing with an online lender who determines that the liquidation value of the assets is $350,000. The lender then agrees to lend you 80% of that amount, which would total $280,000 at a flat 17% interest rate.

Let’s say you use the full $280,000. With a repayment term of 12 monthly payments, you would have to pay back $327,600 ($280,000 plus $47,600 in interest) in total. That works out to $27,300 per month.

After 12 months, you pay back what you borrowed in full. You have full access to the $280,000 again and could draw against your line of credit to buy inventory as needed.

Let’s say you get a better deal by buying inventory in bulk, so you decide to draw $50,000. You would still have access to the remaining $230,000, and once you pay back the $50,000 you used (plus interest), your credit limit would return to $280,000.

With either type of financing, the inventory you buy serves as collateral for the loan. The amount you can borrow depends on the lender. For instance, you may be able to borrow up to 100% of the inventory’s liquidation value with Lender A. But Lender B might only allow you to borrow up to 70% of liquidation value. It’s common for lenders to request a professional appraisal to determine the liquidation value of any inventory you plan to buy.

Pros and Cons of Inventory Financing

Like any other type of small business financing, it’s essential to consider both the advantages and disadvantages of inventory loans. Weighing the pros and cons can help you decide if it’s the right type of financing to meet your inventory purchasing needs.

Pros:

- Using inventory as collateral means you don’t need to provide business or personal assets to secure the loan.

- Loan funding is generally fast once you’re approved.

- Less-than-stellar personal credit isn’t necessarily a deal-breaker for approval.

- Newer businesses are eligible, as you typically only need a year (and sometimes as little as six months) of operation to qualify.

- You can move quickly to purchase inventory when discounts or bargains come along.

- Inventory financing can help you stock up for the busy season so you don’t miss out on sales.

- You can free up cash that is tied up in inventory.

Cons:

- You will likely not be able to borrow the full amount needed to purchase inventory.

- Inventory financing typically requires more due diligence than other business loans to determine the inventory’s liquidation value, which can be time-consuming and costly.

- Some lenders may require you to need a minimum amount of financing to borrow (in some cases as much as $500,000).

- Interest rates are typically higher compared to other small business financing options.

- Your lender may require regular check-ins (typically from a third-party auditor) to monitor inventory levels and sales.

Also, keep in mind you can only use inventory loans to purchase inventory. If you were to get a regular term loan or a line of credit, on the other hand, you could use the money for inventory or any other purpose for your business.

Is Inventory Financing Right for My Business?

Inventory financing can be a good funding option when you need to purchase inventory and tangible products. You might consider using an inventory loan for one of the following reasons:

As such, this type of loan is not suitable for service-based businesses. Ecommerce and brick-and-mortar retailers, as well as wholesalers, are the most common business types that borrow.

This form of funding may be right for you if:

- You are a product-based business with a single funding need of purchasing inventory.

- Your business financials or credit score would make it difficult to qualify for other types of traditional financing.

- You’d rather avoid having to offer other business assets or personal assets as collateral for a loan.

- You have a strong sales record and are confident in your business’s ability to sell the inventory to repay the loan quickly.

- You feel comfortable having the lender or financing company monitor your inventory turnaround as a condition of financing.

- You don’t mind ongoing inspection from a third-party auditor while your line of credit or loan is outstanding.

Beyond these, consider what kind of repayment terms you might qualify for and how that could affect your monthly cash flow. Specifically, evaluate the return on investment from purchasing the inventory in question versus what you’ll pay for the loan monthly and in total once you factor in interest and fees.

How to Prepare for an Inventory Loan

If you think an inventory loan is right for you, you’ll need to keep the lender or financing company’s requirements in mind. Then you won’t waste time applying for a loan you won’t qualify for.

Am I Eligible?

Every lender and financing company has different guidelines for inventory loans. Most lenders will require you to have at least a year of operations under your belt, although it is possible to find lenders who only need six months.

Generally, you can expect them to consider any of the following when you apply for financing:

- Personal and business credit history and scores

- Amount of financing needed

- The estimated value of the inventory to be purchased

- Quality of your business’s inventory management system

- Typical inventory turnover ratio

- Annual revenue

- Financial statements, such as profit and loss and cash flow statements

Mostly, lenders want proof you’ll be able to repay what you borrow to purchase inventory. And if you default for whatever reason, lenders want to be sure they could sell any remaining stock for a reasonable amount to recoup the outstanding loan balance. Those things tend to be most important for getting approved for inventory financing. However, your credit scores and overall business financials also might play a role.

What Documents Do I Need to Apply?

If you’re ready to apply for inventory financing, here’s an overview of the various documents you may need to gather.

Business and Personal Tax Returns

Depending on how long you’ve been in business and how your business is structured, an inventory financing company may want to see your business and personal tax returns. Be prepared to offer your returns for at least the previous two tax years.

Business and Personal Bank Statements

Lenders may want to take a closer look at what assets you have in the bank and how money moves in and out of your accounts. They may ask you for the most recent two–three months’ worth of statements from both personal and business accounts.

Current Inventory List

You should also be prepared to show a lender or financing company a current listing of your inventory, including where it’s stored. If you know the inventory’s estimated liquidation value, it’s also a good idea to include that.

Inventory Management System Details

Your lender will want to take a closer look at how you manage and track your inventory. So you’ll likely need to share records demonstrating:

- How often your inventory turns over

- How much of your inventory you were unable to sell

- How much profit you’ve made on inventory sold

Balance Sheet

Your balance sheet shows your assets, liabilities, and capital at any given moment in time. Financing companies can take a look at your balance sheet for the current year and the previous year or two to get a sense of how financially sound your business is.

Profit and Loss Statement

In addition to the balance sheet, you may need to provide an up-to-date profit and loss statement. Lenders may go a step further and ask to review your profit and loss statements for the previous year or two.

Sales Forecast

Of course, a lender’s also going to be interested in what your sales may look like in the future. They may require and accurate and up-to-date sales forecast to complete your inventory financing application.

What Happens Next?

Once you submit your application, the lender will begin the review process. That includes initiating a due diligence period to review your financials and completing an appraisal of the inventory.

At this point, you may be given an initial quote for loan terms and asked to pay a due diligence fee. Paying the fee doesn’t guarantee you’ll qualify for financing. During the due diligence period, the lender may have a third-party company review and audit your inventory management system and business finances. A separate company may conduct the appraisal.

If everything checks out to the lender’s satisfaction, the final step is signing the loan paperwork and receiving the loan funds. The timing for all of this can vary from lender to lender. But, once you’re approved, it’s possible to get the funds deposited in your bank account in just a few days.

Other Ways to Finance Inventory

Inventory financing is a good option for purchasing inventory, but it’s not the only one to consider. Here are some alternative ways to finance inventory for your business.

Term Loan

A term loan allows you to borrow a lump sum, which you repay over time, according to a schedule set by the lender. The amount you can borrow with a term loan can vary, though you may be able to find loans with maximum limits of up to $1 million.

Term loans can be secured or unsecured, though you’ll typically need strong credit and solid financials to qualify for an unsecured loan without collateral. Using a term loan to buy inventory means you wouldn’t be subject to the sometimes strict due diligence process associated with inventory financing.

Purchase Order Financing

Purchase order financing is another way to leverage business assets without having to offer collateral. With this type of arrangement, the purchase order financing company pays your suppliers. Your suppliers then ship products to your customers. Customers pay the financing company, which then passes the money along to you, less any fees it charges.

Merchant Cash Advance

A merchant cash advance (MCA) could be a good option if you have consistent credit card sales. Merchant cash advance companies advance you a set amount of money based on your credit card sales. You then repay that money, along with the financing company’s fee, out of your daily credit card sales. An MCA may be an attractive option if you are a new business or your credit score isn’t high enough for other financing types. Borrowers beware: an MCA is one of the most expensive business financing options on the market.

Crowdfunding

Crowdfunding platforms allow you to access financing using pooled funds from multiple investors. Investors profit from the interest you pay on the loans. If you’re considering crowdfunding to raise inventory financing, review the platform’s guidelines carefully. Some require you to fund campaigns before you can fully access the money, and the majority charge a fee for raising funds.

Vendor Financing

If you purchase inventory from your vendors, you may be able to get financing through them directly. For example, a vendor tradeline could be a convenient way to buy items on credit without having to offer collateral. It can also help build your business credit score if the lender reports your repayments to the business credit bureaus.

Getting vendor financing can be tricky, however, if you have a newer business. Vendors typically prefer to extend funds to companies they have a history of working with. Remember to compare financing terms if you’re approved, so you know how much you’ll pay and when those payments are due.

Short Term Loans

Short term loans are term loans that have a shorter repayment period. Instead of taking three or five years to pay off a loan, you might repay a short term loan in 3–6 months. Short term loans can be useful for purchasing inventory if you expect a relatively quick turnaround and have a smaller borrowing need.

Accounts Receivable Financing

Accounts receivable financing allows you to leverage your outstanding invoices to get funding for your business. The financing company lends you an amount of money based on the value of your unpaid invoices. You then repay that money over time as your invoices are paid, along with a fee the financing company charges. Accounts receivable financing means you don’t have to provide collateral. But similar to merchant cash advances, it can be one of the most expensive forms of small business financing.

Weigh All the Options for Financing Inventory

When considering any financing path for purchasing inventory, run the numbers carefully. Look at how much you can borrow and whether that’s sufficient to meet your inventory-buying needs.

Also, add in the interest rate and fees, so you know the annual percentage rate (APR). The APR reveals the total cost on a yearly basis of a loan or line of credit. Compare prices from different lenders and read the fine print before signing off on financing, so you know what you’re agreeing to.