There’s a lot involved in running an e-commerce business — from managing inventory to fulfilling orders — and in many ways, Amazon has simplified these steps for online retailers, especially through Fulfillment By Amazon. However, while Amazon can collect sales tax on a seller’s behalf, it’s the seller’s responsibility to determine where that sales tax needs to be collected.

This can be especially complicated for online retailers because sales tax laws are subject to change and the amount of sales tax a seller must collect depends on numerous factors. That’s why it’s important for sellers to familiarize themselves with sales tax policies not only in their own state, but also in the states where they do business.

What is sales tax?

Sales tax is a tax on items that’s paid to a governing body. It’s a percentage of a sale that’s charged to a customer and typically collected at the point of purchase. As an Amazon seller, you’re responsible for collecting sales tax, and it’s your responsibility to charge buyers the correct amount of sales tax in each state and remit the collected taxes back to the state. Failure to do so could have serious consequences. The states you owe sales taxes in could request that you pay years’ worth of taxes, as well as penalties for late payments, and tax authorities could potentially seize your business and personal assets.

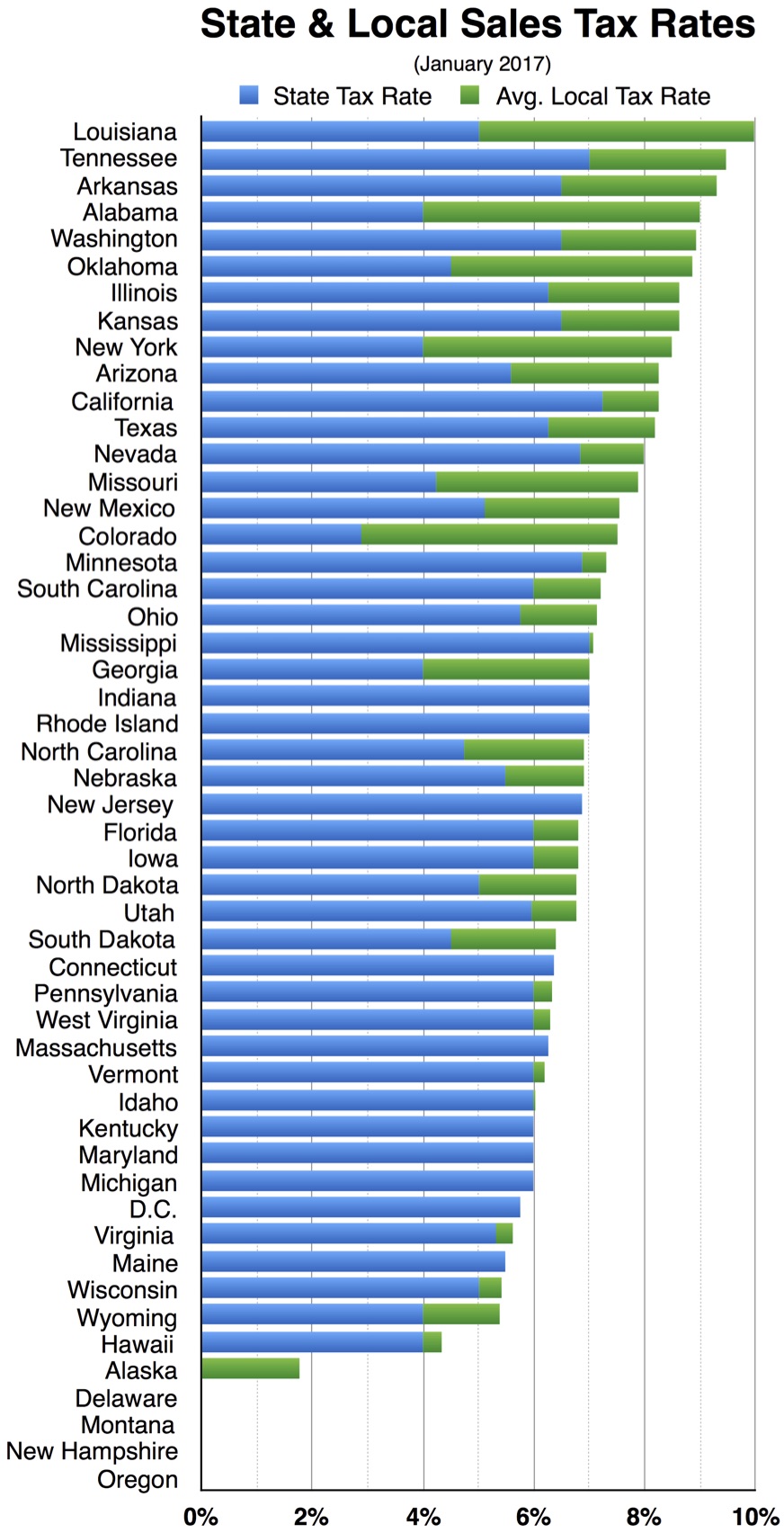

Forty-five states and the District of Columbia levy a sales tax. Only Alaska, Delaware, Montana, New Hampshire and Oregon don’t have one. The table below displays the tax rate and average local tax rate of U.S. states as of January 2017.

In addition to state sales tax, most states also permit cities, counties, and special taxing districts to charge a sales tax. For example, the combined sales tax rate in Pasadena, California, is 10.25% because the state sales tax rate is 6%, the Los Angeles County sales tax rate is 0.25%, the Pasadena sales tax rate is 0.75%, and there’s a special tax of 3.25%. States, cities, and other local areas use this sales tax to pay for items like schools and roads.

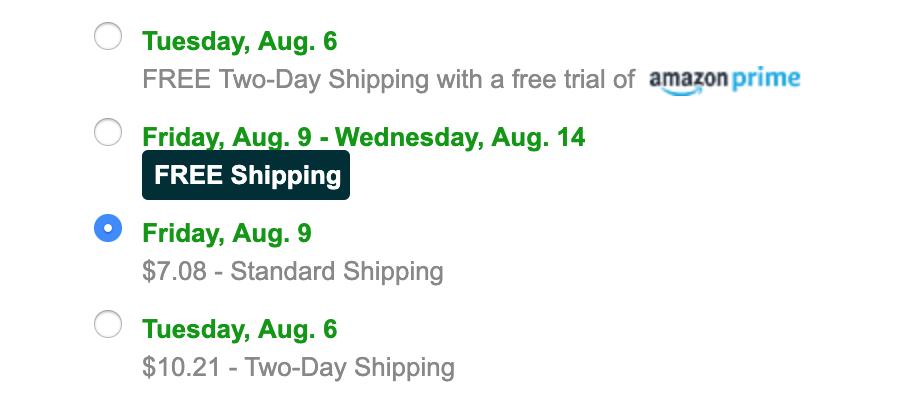

Some states, such as Colorado, Georgia, and Texas, also charge sales tax on shipping costs. It doesn’t matter if the shipping charge is part of the price of the item or if it’s listed separately from it. However, some states, such as California, Maine, and Virginia, don’t tax shipping charges as long as the shipping charge is listed separately from the item price, such as in the example below.

These states do consider shipping charges to be taxable, if you include the shipping charge in the price of the item instead of listing them separately.

When you have to charge Amazon sales tax

Amazon sellers are required to charge sales tax in states where selling meets two criteria: product taxability and sales tax nexus.

Product taxability means the product you’re selling on Amazon is eligible to be taxed, and typically any tangible object is subject to sales tax. However, depending on the state, some product categories — such as groceries, clothing, and textbooks — are taxed differently or not at all. While most states consider clothing taxable, others consider it nontaxable or only taxable at a certain price. For example, in Minnesota, clothing is tax-exempt except for accessories, fur items, and sports and recreational wear, and in New York, only clothing priced at $110 or less is considered nontaxable.

Sales tax nexus essentially means that your business has a significant presence in a particular state. You’ll have a sales tax nexus in the state where you reside, but you may also have a sales tax nexus in other states depending on the nature of your business.

Determining where you have sales tax nexus

There are numerous ways you can have a presence, or sales tax nexus, in a state, and sales tax laws are subject to change with new legislation and court decisions. This guide from Teampay explains how and why sales tax laws have become more complicated in recent years.

As a third-party seller on Amazon, your presence is always in the state you live, and if you’re an FBA seller, you’ll also have a presence in any state where Amazon stores your inventory. However, you can also have a sales tax nexus in a state without having property or inventory there. A sales tax nexus can be established based on your activities, an employee’s activities, or even the activities of a third party involved in your business.

The establishment of a nexus varies from state to state, but here are the most common nexus-creating activities:

- Your location: As noted above, residing in a state creates a sales tax nexus.

- Inventory and warehouse use: Some states’ tax laws specifically address maintaining inventory and warehouse usage, and typically a sales tax nexus can be created in a state where you have inventory or are involved in fulfillment, regardless of whether you own the warehouse or if your use of it is only temporary. This is especially important for FBA sellers as Amazon has fulfillment centers in twenty U.S. states. However, you’re responsible for paying sales taxes only in the states where you maintain inventory.

- Personnel in other states: If you have an employee that lives in another state, this is often considered a nexus-creating activity. For example, if you live in Georgia but have an employee in Texas, you have a sales tax nexus in Texas and must also collect sales tax from buyers in that state.

- Affiliates in other states: Some vendors offer compensation to people or organizations if they link to the vendor’s website and the link results in clicks or sales. Depending on individual states’ laws, if someone promotes your product in exchange for a percentage of profits, this can also establish a nexus in the affiliate’s state.

How to find where Amazon FBA gives you sales tax nexus

If you’re an FBA seller, you’ll have a sales tax nexus in every state where you have inventory in an Amazon warehouse or fulfillment center. To see where your inventory has been stored for any amount of time, log in to Seller Central, click “Reports” and then “Fulfillment.” Here, you’ll be able to view your Amazon Inventory Event Detail report and download information about the time period of interest to you.

One the report is downloaded, look at the column labeled “fulfillment-center-id” to see a list of Amazon fulfillment centers where your inventory is stored.

Destination-based and origin-based sales tax

If you determine that you have a sales tax nexus in a state that requires sales tax collection, you must collect sales tax from every online buyer in that state regardless of where the item is shipped from. If you don’t have sales tax nexus in a state that requires sales tax collection, you’re not required to collect sales tax when you sell to buyers in that state, regardless of where the item is shipped from.

Because each state can make its own sales tax laws, these laws can differ greatly among states. Some states require sellers to collect sales tax at the point of origin, but most require sellers to collect sales tax based on the tax rate of the destination, or the online buyer’s location.

Most states, as well as the District of Columbia, use destination-based sales tax sourcing, which means that if you live in one of these states and you’re selling to a customer in the same state, you’ll charge the buyer’s local rate, which could include a combination of state, county, city, and district tax rates. For example, if you live in Greenville, South Carolina, and you’re selling to a customer in Charleston, South Carolina, you’ll instead charge the buyer’s local combined sales tax rate in Charleston of 9%.

List of destination-based states:

- Alabama

- Arkansas

- Colorado

- Connecticut

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Nebraska

- Nevada

- New Jersey

- New York

- North Carolina

- North Dakota

- Oklahoma

- Rhode Island

- South Carolina

- South Dakota

- Vermont

- Washington

- West Virginia

- Wisconsin

- Wyoming

However, origin-based sales tax states operate a little differently. If you live in one of these states and make sales to a customer within the state, you’ll charge sales tax based on your location, including any state, county, city, or district tax rates. For example, if you live in Phoenix, Arizona, you’ll charge all customers located in your state the local sales tax rate of 8.6%, even if the buyer resides in Flagstaff, Arizona.

List of origin-based states:

- Arizona

- *California

- Illinois

- Mississippi

- Missouri

- New Mexico

- Ohio

- Pennsylvania

- Tennessee

- Texas

- Utah

- Virginia

*California is a little different from the other states in this list. It’s considered a modified-origin state, which means its state, county, and city taxes are based on origin, but its district taxes are based on destination.

Now that you’ve determined where you have a sales tax nexus, you must acquire a sales tax permit for each state where your business has a presence. Policies on obtaining a sales tax permit can vary among states, but generally, you can simply visit a state’s Department of Revenue website to register your business. You’ll need to provide certain essential information, such as your business name, business address, and an employee identification number (EIN). When you receive your permit, you’ll be able to collect sales tax from customers at the rate determined by the local taxing authority.

How to set up Amazon tax calculation services

Because sales tax differs not only by state, but can also differ by city and county, determining how much you owe in sales tax can be complicated. Luckily, if you have an Amazon Professional Seller account, which costs $39.99 a month, Amazon will begin collecting sales tax on your behalf, even keeping up with whether a state is origin- or destination-based. However, Amazon charges a fee of 2.9% per transaction in order to collect sales tax.

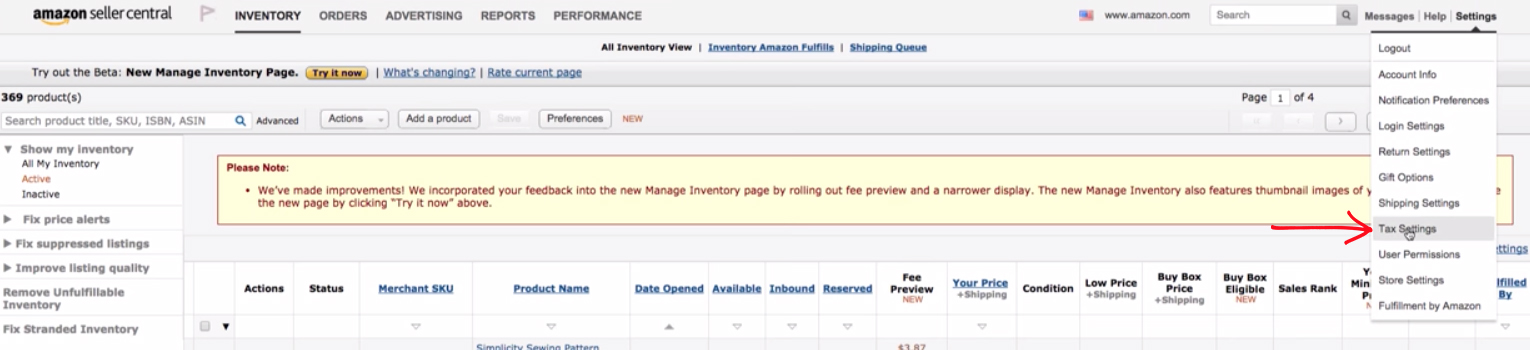

To set up Amazon tax calculation services, log in to Seller Central and select “Tax Settings” from the “Settings” drop-down menu, as indicated below.

If you’re a first-time user, you’ll be asked to review the Amazon tax methodology document and the available product tax codes.

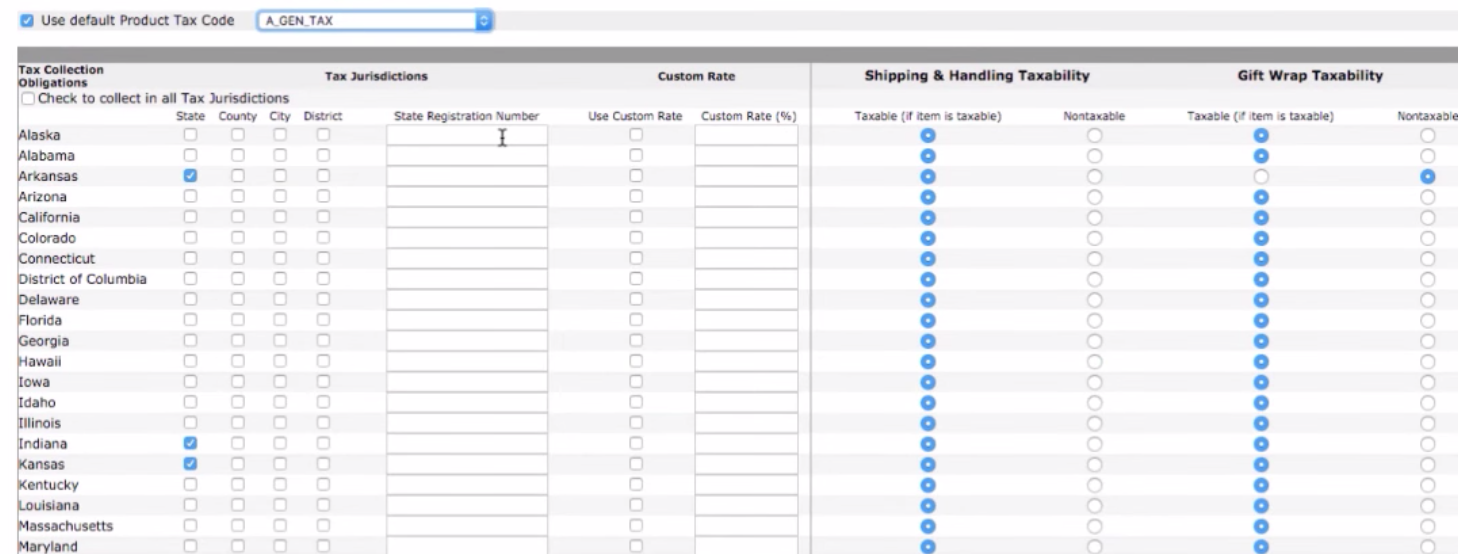

Next, select the state you want to configure tax settings for. If the state you select displays “For all shipments to this state, Amazon manages sales and use taxes,” you won’t be able to set jurisdictions. For every state you indicate you’ll be collecting sales tax in, you’ll need a state tax registration number in order to proceed.

As illustrated above, you simply need to select a state in the far left column and enter your state tax registration number in the field to its right.

You’ll be asked to select jurisdictions, beginning with the state jurisdiction. Select all the jurisdictions — including county, city, and district — that you want Amazon to calculate sales tax for. You can also enable Amazon to charge taxes for shipping and handling and gift wrap, as well as add product tax codes. Product tax codes enable you to charge the correct amount of sales tax on items like food and clothing.

Once you’ve configured your tax settings, click “Save Settings.” You’re now ready to start collecting sales tax on your products.

Amazon sales tax: How to file

While Amazon will collect sales tax for you, you’re responsible for holding the sales tax collected and remitting it to the appropriate taxing authority on time. When you receive a sales tax permit, the state’s department of revenue will assign you a filing frequency. Most states — but not all — have a sales tax due date on the 20th of each month.

As with sales tax rules, every state has different requirements for filing sales tax returns. For example, some states require that you report how much sales tax you collected in each tax district, so familiarize yourself with sales tax information for each state in which your business has a sales tax nexus.

To file your sales tax returns, you can log in to your state’s Department of Revenue or taxing authority website to make a payment. You can also set up automatic payments through tax software, or work with an accounting professional to file the returns on your behalf.

When Amazon sales tax isn’t charged

Sales tax isn’t collected on qualifying items during sales tax holidays. During these periods, purchases of qualifying goods from customers within qualifying states will be exempt from state and sometimes local sales taxes.

Sales tax holidays occur annually in many states, and there are two main types. During back-to-school sales tax holidays, school supplies, clothing, computers, and other educational items may be exempt from sales tax. States that commonly experience severe weather, such as hurricanes, may also have a period when emergency-preparedness items, including generators, batteries, flashlights, and hurricane shutters, are exempt from sales tax.

Ensure your sales tax settings are correct

Clearly, there are a lot of factors involved in Amazon sales tax, which can make the process of collecting and remitting sales tax seem daunting. While Amazon will collect sales tax on your behalf, you’re responsible for properly establishing your sales tax settings, registering with the states your business has a presence in, and reporting and filing sales tax. If you have questions about sales tax, contact your state’s taxing authority or an accounting professional.