More and more of my acquaintances are buying and selling ecommerce businesses.

Buying an ecommerce business, or any business, is never easy (or cheap). While things might look great on the surface, there are always a few “minor issues” hidden inside every business, particularly small ones. In this post, I want to go over the guidance I offer to my friends and acquaintances when they tell me about their big plans.

This isn’t intended to be an exhaustive list of due-diligence steps—far from it, in fact. While due diligence in a business acquisition involves seeking advice from legal/financial experts, there are a few checks you can do before things even get that far.

Ignore aspirational pitches, stick to facts

It’s easy to get caught up in aspirational sales pitches from business owners. You know the kind:

“I haven’t put much effort into ______, but if you did ______, you could easily triple the income.”

Oh, really? If that’s the case, why hasn’t the seller tripled the income already? By doing so, they’d be able to line their pockets and sell the business for dramatically more. If tripling turnover were as easy as they’d like you to believe, they would have done it themselves, make no mistake about it.

When you find an ecommerce business for sale, skip straight to the facts and figures—net income, profit margin, operating costs. Don’t get caught up in all the fluff of a sales pitch. It means absolutely nothing and shouldn’t be a determining factor in your decision.

Don’t buy a business based on someone else saying there’s potential. Buying an ecommerce business on its potential should only be done after your own calculations and assessment of the industry have been exhaustively performed.

Determine whether sales are sustainable

Every few years here in the U.K., there’s a big yo-yo craze. Kids go absolutely mad for yo-yos for a month or two—and sellers of yo-yos must make a fortune. David Strang, managing director of Wicked Vision, the distributor of Duncan yo-yos, says that yo-yos have enjoyed a surge in popularity every 7 to 8 years for the past 80 years in the U.K.

But then interest dies off, and yo-yos become the epitome of “uncool.” This is just one example of a niche where sales really aren’t sustainable or stable. Would I buy a yo-yo business? No, I don’t think I would.

When buying an ecommerce business, it’s important to establish that there’s consistent demand for the products you’re going to be selling. If you bought a yo-yo business after a month of high demand, you’d pay top dollar. When demand dies off, you’d be left with a business that turns over very little.

Sure, some seasons, like Christmas, can be more profitable than others for most ecommerce businesses. But you want to buy an ecommerce business whose sales are fairly consistent year round—not a business whose sales come in phases spaced over years or even decades.

Find out why it’s for sale

You don’t just sell a profitable business without thinking it through properly.

For many people, it’s a case of wanting to retire early and live the easy life. For others, it’s selling off one venture so they can focus entirely on another. Dig deep to find out exactly why the business you’re interested in is being sold. There are lots of snake-oil salesmen who are selling worthless online businesses for jaw-dropping sums of money.

If a person doesn’t have a genuine reason for selling a business (as far as you can tell), alarm bells should be ringing, and you should continue with your due diligence before parting with a dime.

Speak to suppliers & ensure they’ll stock you

A lot of suppliers out there have select distribution agreements in place.

Many of those suppliers still aren’t comfortable distributing to online retailers, or, in their mind, to parts (or people) unknown. Just because a business sells X, Y, or Z products at the moment doesn’t mean that their supplier will continue to supply you once you buy the business.

With that in mind, get written confirmation from suppliers that they’ll continue to support you if you buy the website or the business from the seller. If not, it might be time to bail out—or look seriously at alternative suppliers if you’ve determined that the business is still viable without the current suppliers.

Understand traffic sources and costs

Not all web traffic is equal. Some comes via referrals from other websites, some comes from search, and some comes from paid search networks.

Before you buy an ecommerce business, it’s important to find out where your buyers come from and how much they cost.

A website might be generating $5,000 in sales every day, which, on the surface, is a great figure. But if that website relies on paid traffic, and they’re spending 50% of their sales to drive it, the sales figures start to look a bit less glamorous.

Take time to look over the business’s analytics to determine where traffic comes from and how much it costs.

Be careful to ensure that it’s sustainable, too. If traffic comes from search, for example, it could be advantageous to have an SEO consultant analyze the site’s backlink portfolio. A bad backlink portfolio could mean a Google penalty is imminent—which would also mean a collapse in sales is just around the corner.

The past performance of a business should mean nothing to you; it’s up to you to determine if the business is sustainable and profitable for the long term.

Look past GMV and focus on PROFIT

It’s really easy to get caught up in seven- or eight-digit gross merchandise volume (GMV) figures when you buy a website; maybe it turns over $5,000,000 a year, or even $50,000,000 a year. While those figures are like candy for anyone new to business, they’re generally irrelevant to seasoned business buyers. Let’s say a website turns over $50,000,000 a year but makes less than $10,000 profit; you should pay based on the site’s profit, not on the GMV figure.

Vendors and brokers like to push the turnover figure because it looks impressive, but turnover means little if expenses are high and profits are minimal. You need to get down to the nitty-gritty—you need to know exactly how much profit is made after all fixed and variable costs have been factored into the equation. I can say with near certainty that the figure will be nowhere near the $50,000,000 mark.

Find a business valuation method

Buying an ecommerce business is a major financial investment. Before you make that decision, you want to ensure that the purchase will bring a worthwhile return.

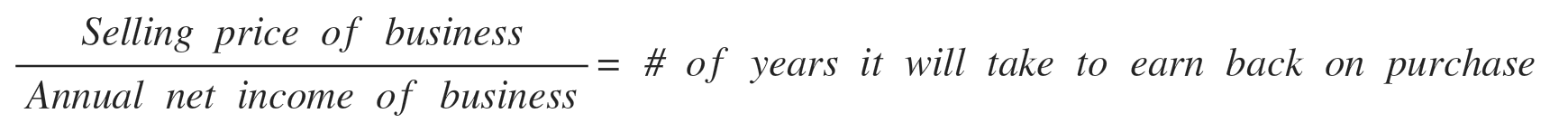

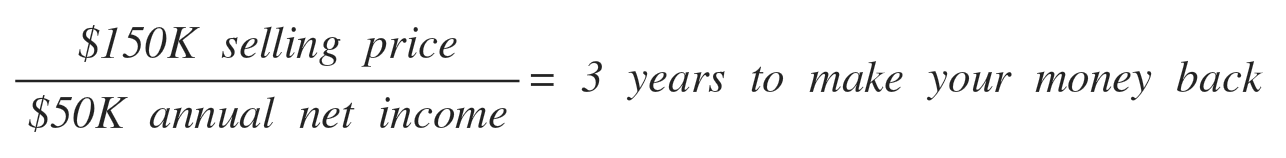

To assess the quality of the purchase, you need a business valuation method, such as this multiple of earnings formula.

Using this formula to understand how long it will take to earn profits after purchasing gives you a sense of whether the business is worth buying.

Say, for example, you’re looking at a listing where the business earns $50K per year in net income, and the selling price is $150K. Based on this formula, it would take 3 years to start earning a profit on your purchase.

This valuation method is especially helpful when you set a maximum multiple of earnings amount. Entrepreneur Michael Jackness recommends keeping your earnings multiple around 2 to 2.5, or paying no more than it would take to make a profit in 2 to 2.5 years. Anything greater requires a lengthy wait to make a profit, which is unwise in ecommerce because market conditions can drastically change year to year.

By having a clear way to measure the potential value of a business, you can feel confident in your decision to purchase or not purchase.

Take business information packets seriously

When you inquire about a business for sale on company-listing platforms, you’re sent a packet of key information about the business, including key factors such as:

- Profit and loss statement

- Business tax returns

- Employment agreements

Full of valuable information, these packets are the foundation of your potential purchase. Without these documents, you can’t properly evaluate whether a business is worth purchasing.

Given the importance of these packets, here’s what to keep in mind as you review them:

- Don’t be dismayed if most packets aren’t appealing. Buying a business is a major financial investment, so you want to be extremely comfortable and happy with the company you choose to buy. Continue reviewing packets until you find one that meets your criteria.

- Request more packets than you think you’ll need. Finding a business that is worth your financial investment takes time. Inquire about many listings so that you have a greater chance of coming across a business that meets your criteria.

- Look for red flags. Certain signs—no employees, the business is very young—are clear indicators that a business isn’t worth investing in. Decide what your deal breakers are, and look out for them in business documents.

Sifting through every business’s documents takes time and effort. But taking the time to assess each company can seriously pay off when you find the best deal that meets your needs.

Scrutinize the P&L statement

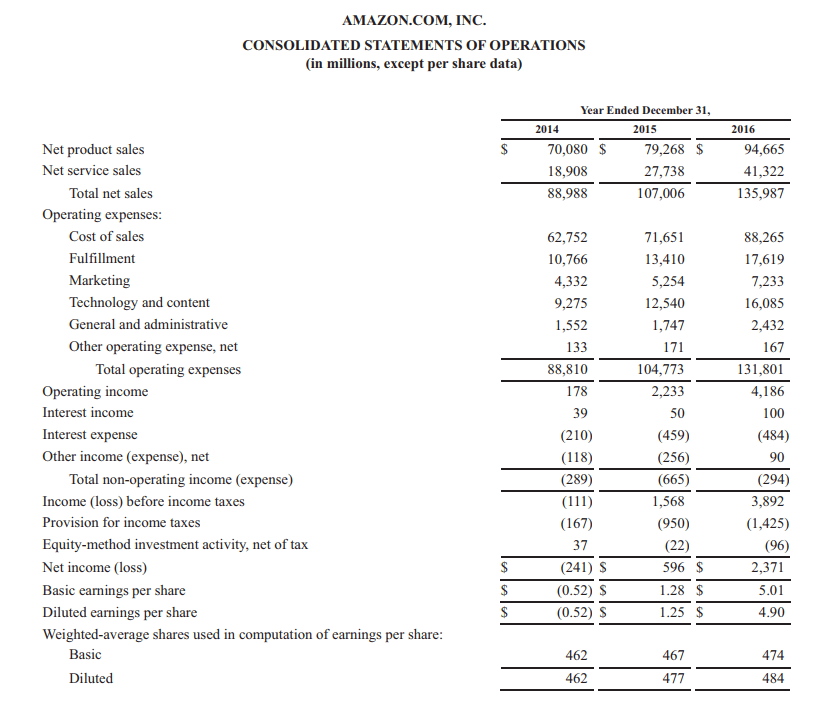

While it’s important to review all of a business’s key financial documents, the profit and loss (P&L) statement may be the most crucial one to assess.

The P&L statement is especially valuable because it’s so comprehensive. It details the revenue, costs, and expenses of a business over a period of time.

[Source]

With this financial picture, you can evaluate a company’s ability to make a profit by reviewing factors such as the following:

- Sales: Tracking the sales of a business can help you determine how much revenue to expect and whether revenue is consistent. Determining whether seasonality impacts sales is necessary to decide whether purchasing the business is worthwhile in the long run.

- Cost of goods sold: Analyze the cost of goods sold to ensure that it increases or decreases with revenue. If it doesn’t, consider why the cost is high and whether there are opportunities to lower it without hurting revenue.

- Net income: A business’s net income, or revenue minus expenses, should be positive and, hopefully, should grow over time. If you see a negative net income, investigate to find a possible reason—a costly strategic investment, for example—to ensure the business is healthy.

The P&L statement is an essential foundational document when buying an ecommerce business. Steer clear of companies that are unable or unwilling to provide a P&L sheet—without it, you can’t make a reasonable, well-founded purchasing decision.

Identify what you could improve

Once you’ve learned about the business’s background, it’s time to determine whether you could improve the business’s practices enough to increase net income and receive a greater return on your purchase.

A business’s net income is the gross revenue minus the expenses, so increasing net income means increasing gross revenue and lowering expenses. To meet these goals, here are areas of improvement to consider:

- Lower the cost of goods sold. Look at the business’s suppliers and see if there are opportunities to lower the COGS, such as getting a discount from a supplier by buying in bulk or paying in cash.

- Improve the design of the site. Design matters with ecommerce—the look of a site needs to reflect the image and lifestyle the business is trying to sell. If sales are relatively strong but the business’s online store needs work, redesigning with a professional could potentially boost sales even further.

- Increase the number of sales channels. Look at what channels the business is currently using, and consider whether there are other platforms you could sell on to increase sales further.

- Lower the cost of other expenses. Consider whether certain business costs—subscription payments for software, selling channel account costs—could be lowered or eliminated.

Finding ways that expenses could be lowered and revenue could be increased, based on a business’s financial docs, will help you determine whether the net income could be improved enough to make purchasing the company a worthy investment.

Buying a business takes knowledge and caution

Buying an ecommerce business is exciting—but it’s also incredibly risky. You’re making a major financial investment, which means that there’s great potential for losses if you purchase recklessly.

To set yourself up for financial success, approach business listings with knowledge and caution. Do your research to assess whether the company is worth its selling price and could bring profits in the long run. Ask the right questions and look at the details to ensure that your potential acquisition is a smart investment.

This article was originally written by Nick Whitmore and updated by William Harris on May 15, 2018.