Etsy may have a small-business feel to it with a focus on crafts and handmade goods, but it’s doing big business.

The marketplace’s total revenue was $197.9 million in the third quarter of 2019 alone, and Etsy collects and remits sales tax just like other major e-commerce sites.

But when it comes to individual sellers paying their Etsy sales tax, they often have a lot of questions, including when to charge sales tax, how much to charge, when to collect it, and where to remit it.

Here’s everything you need to know about Etsy sales tax, so you can ensure you’re in compliance with both Etsy and government policy and can focus your attention on what matters most: making and selling your products.

Why is Etsy Sales Tax Important?

No matter what size your business is—even if you’re just selling the occasional hand-knit scarf—you still have to pay sales tax in the United States.

As an Etsy seller, you must collect sales tax on items you sell, and it’s your responsibility to charge buyers the correct amount of sales tax in each state and remit the collected taxes back to each state.

Failure to do so could have serious consequences. The states you owe sales taxes in could require you to pay years’ worth of taxes, as well as late-payment penalties, and tax authorities could potentially seize your business and personal assets.

But before you can begin collecting Etsy sales tax, you need to know how much to collect, and when.

Determine Where to Charge Etsy Sales Tax

As a seller, you must charge sales tax in states that impose a sales tax, where you also have a sales tax nexus.

Forty-five states and the District of Columbia levy a sales tax—only Alaska, Delaware, Montana, New Hampshire, and Oregon don’t.

You have a sales tax nexus in a state where your business has a significant presence. For example, if your company is based in New York, but you have an office in Utah, you’d owe both New York and Utah sales tax, as you have a nexus in both of those places.

Of course, taxes are never quite so simple. Just as sales tax rates vary among states, what constitutes a nexus can vary among states, too.

You may also have a sales tax nexus in some states, depending on the nature of your business. Here are some common business activities and events that indicate a nexus:

- Your location: As noted above, your business being located in a state that collects sales tax creates a sales tax nexus.

- Inventory and storage locations: A sales tax nexus can often be created in a state where you have inventory or are involved in fulfillment, regardless of whether you own the warehouse or storage facility.

- Personnel in other states: If you have an employee that lives in another state, this is frequently considered a nexus-creating activity. For example, if you live in Colorado but have an employee in Texas, you have a sales tax nexus in Texas and must also collect sales tax from buyers in that state.

- Affiliates in other states: Some sellers offer compensation to people or organizations if they link to the vendor’s Etsy shop and the link results in clicks or sales. Depending on individual states’ laws, if someone promotes your product in exchange for a percentage of profits, this can also establish a nexus in the affiliate’s state.

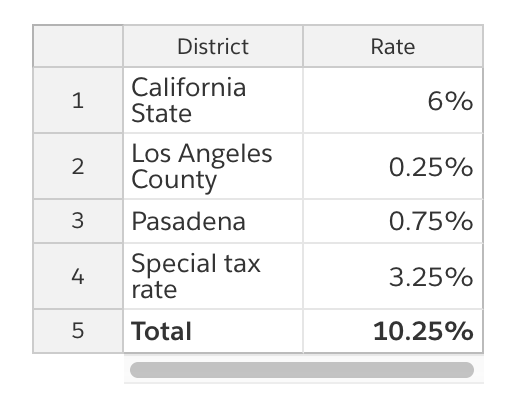

It’s important to note that most states also allow cities, counties, and special taxing districts to charge a sales tax, so you may be responsible for collecting more than simply state sales tax. For example, the combined sales tax rate in Pasadena, California, is 10.25% because it breaks down as follows:

Also, even though Alaska and Montana don’t impose a sales tax, they do allow localities to charge sales tax, so you may be responsible for collecting sales tax for cities, counties, or special taxing districts in these states.

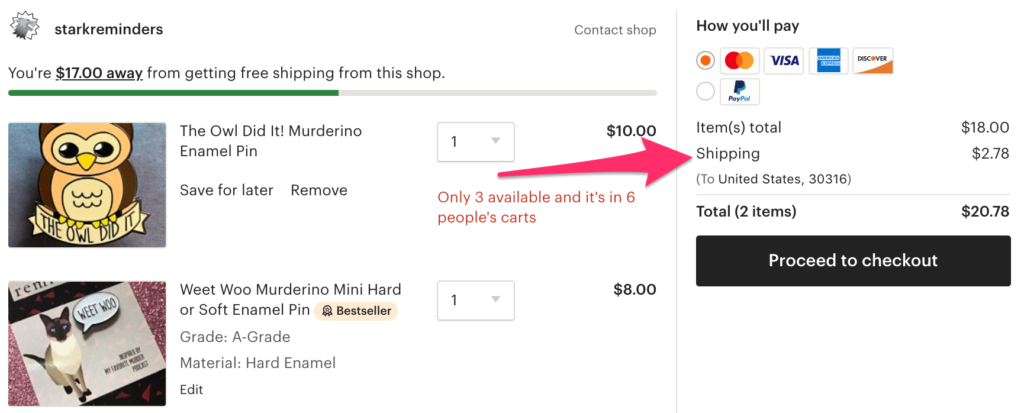

Some states may also charge additional sales tax on gift wrapping and shipping costs. It doesn’t matter if the shipping charge is part of the price of the item or if it’s listed separately.

However, some states, such as Maine and Virginia, don’t tax shipping charges as long as the shipping charge is listed separately from the item price, as in the example above.

Also, keep in mind that tax laws are subject to change with new legislation and court decisions. This guide from Teampay explains how and why sales tax laws have become more complicated in recent years.

Destination-based and origin-based sales tax

To further complicate matters, some states require sellers to collect sales tax at the point of origin, or where a product ships from. However, most states require sellers to collect sales tax based on the tax rate of the destination, or the online buyer’s location. These are known as origin-based and destination-based sales tax, respectively.

Most states, as well as the District of Columbia, use destination-based sales tax sourcing. This means that if your business is based in one of these states and you’re selling to a customer in the same state, you’ll charge the buyer’s local rate, which could include a combination of state, county, city, and district tax rates.

For example, if you live in Greenville, South Carolina, and you’re selling to a customer in Charleston, South Carolina, you’ll charge the buyer’s local combined sales tax rate in Charleston of 9%.

If your business is located in a destination-based sales tax state and you sell a product to a customer outside of your state, you won’t charge sales tax on the item.

Destination-based states:

- Alabama

- Arkansas

- Colorado

- Connecticut

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Nebraska

- Nevada

- New Jersey

- New York

- North Carolina

- North Dakota

- Oklahoma

- Rhode Island

- South Carolina

- South Dakota

- Vermont

- Washington

- West Virginia

- Wisconsin

- Wyoming

However, if your business is located in an origin-based sales tax state and you make a sale to a customer in your state, you’ll charge sales tax—including any state, county, city, or district tax rates—based on your business’ location. For example, if you live in Phoenix, Arizona, you’ll charge all customers located in your state the local sales tax rate of 8.6%, even if the buyer resides in Flagstaff, Arizona.

Origin-based states:

- Arizona

- *California

- Illinois

- Mississippi

- Missouri

- New Mexico

- Ohio

- Pennsylvania

- Tennessee

- Texas

- Utah

- Virginia

*California does things a little differently. Its state, city, and county sales taxes are origin-based, while its district sales taxes are destination-based.

Also, it’s important to note that Etsy automatically calculates, collects, and remits state sales tax on orders shipped to some states. You can view the list of those states here.

Determine Which Products to Charge Etsy Sales Tax on

Etsy sellers are generally required to collect sales tax on most— but not all—physical goods. Each state has a unique list of taxable goods, and some items may be exempt from sales tax, depending on the state and product category.

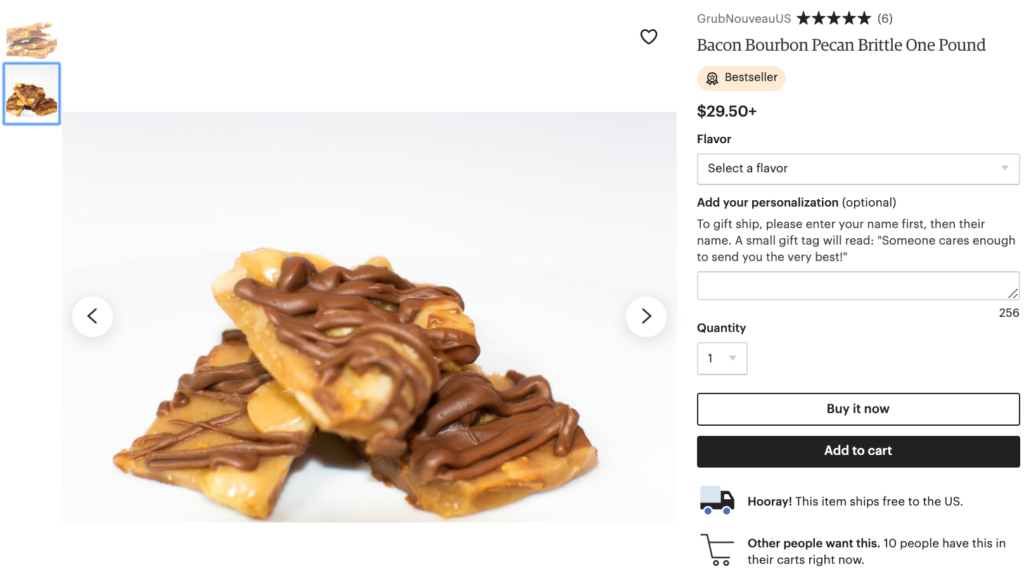

Items that are typically exempt from sales tax include food, clothing, and textbooks, so the majority of Etsy sellers will need to charge sales tax on their products. However, if you sell clothing, food, or candy, such as in the example below, you may be exempt from charging sales tax on those items in certain states.

For example, while clothing is taxable in most states, others consider it taxable only at a certain price or don’t tax it at all. In Minnesota, for instance, clothing is tax-exempt except for accessories, fur items, and sports and recreational wear. In New York, only clothing priced at $110 or less is considered non-taxable.

As laws change, determining which products Etsy sellers need to collect sales tax on can become even more complicated. For example, Washington exempts candy from sales tax, but not if the candy needs to be refrigerated. And the sale of yarn in Pennsylvania is subject to sales tax, but not if the yarn is used to make clothing.

For a complete list of taxable goods in a specific state, visit that state’s department of revenue website.

Register to Collect Etsy Sales Tax

Now that you know where you have a sales tax nexus and which items you must charge sales tax on, you need to register for a sales tax permit, if it’s required. This information can typically be found on a state’s department of revenue website.

Some states charge a fee to apply for a sales tax permit, including Arkansas ($50), Connecticut ($100), and Wyoming ($20). However, many other states, such as Georgia, North Dakota, and Vermont, don’t charge a fee at all. You can view a full list of sales tax permit costs by state here.

It’s important to note that some states may require you to renew your sales tax permit after a certain amount of time. Also, some states may automatically renew your permit, while other states’ sales tax permits may never expire.

When applying for a sales tax permit, you’ll need your taxpayer identification number—such as a social security number or federal employer identification number—to register with a state or city to collect sales tax for your Etsy business.

How to Set Up Sales Tax Rates on Etsy

You’re now ready to begin collecting sales tax in your Etsy shop.

Once your shop is live, go to Shop Manager > Finances > Payment Settings. Then, select the Sales Tax tab.

Next, select a U.S. state or Canadian province and enter a zip code or postal code, depending upon where your business is based. Then, enter the tax rate you need to charge in decimal format.

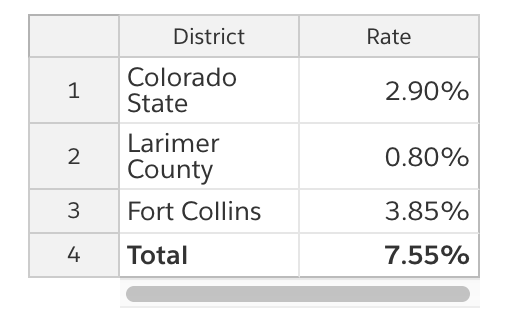

For example, if you operate your business out of your home in Fort Collins, Colorado, you may enter the zip code “80521” and a tax rate of 7.55% to cover the state, county, and city sales taxes as broken down below.

Repeat these steps for any additional locations and tax rates you need to collect.

When you’re finished, click “Save.”

Now that you’ve added sales tax rates to your shop, new items you list on Etsy will have the correct tax rate applied by default. If you don’t want to charge sales tax on a particular item, simply uncheck the box next to the item’s price when creating or editing the listing.

Remember that Etsy automatically calculates, collects, and remits sales tax for items shipped to these states. Sellers can’t opt out of having these sales taxes automatically collected by Etsy.

For more information on adding sales tax to Etsy listings, check out this post.

File Your Etsy Sales Tax

You can see how much sales tax you’ve collected on Etsy by downloading the CSV file of your Etsy sales. While Etsy breaks this information down for you by transaction, it’s your responsibility to remit and file returns.

Each state has its own policies about when sales tax you’ve collected is due. While some will require you to pay sales tax quarterly, others may let you file annually, as long as the total amount of sales tax you owe is below a certain amount. To determine when you must file sales tax, visit the state’s department of revenue website.

Also, each state has different requirements for filing sales tax returns. For example, some states require that you report how much sales tax you collected in each tax district, so familiarize yourself with sales tax information for each state in which your business has a sales tax nexus.

You can file sales tax through the mail or online through a state’s department of revenue.

Take Care of All Aspects of Your Etsy Business

As an Etsy seller, you’d probably rather be crafting original pieces or even writing winning descriptions for your listings than researching tax rates. However, ensuring your sales tax rates are correct and filing your taxes on time are essential parts of running a profitable Etsy business.

And by taking care of all aspects of your e-commerce business, you’ll be well on your way to becoming an Etsy success story.