Deciding to start a business is the easy part. Figuring out how to raise capital, not so much. From building a website to buying inventory, business costs add up quickly. That’s why 40% of business owners turn to small business loans to finance their stores — to the tune of $600 billion in 2017.

Here’s the thing, though. You, like many other sellers, might not want to go this route but feel like you have to in order to get your store off the ground.

The good news is it’s not all financial doom and gloom; you have lots of other options available to finance your small business. For starters, venture capital and angel investing aren’t just for up-and-coming software companies. E-commerce sellers can benefit here as well.

To help you wade through the ins and outs of financing, funding, and bootstrapping a small business, let’s look at what each of these options involves and how you figure out which one’s the best for you.

Finance to Put Money in your Pocket Quickly

Getting a loan is a simple process and successful applications get funds quickly. David Nilssen, co-founder and CEO of Guidant Financial, explains that “unsecured loans can provide up to $150,000 in small business financing without personal collateral required from the business owner.” He continues, “What’s more, the funding process is fast — most deals close within three weeks or less.”

To figure out what type of loan is best for you, here are the most popular types to consider:

- Line of credit. This acts a little like a pool of funds you can dip into whenever you need. For example, if you need funds to run a massive ad campaign during your peak season, a line of credit will help with that.

- Microloan. This is an option for small, one-off projects that don’t require a lot of capital. For example, if you want to overhaul your website and need to hire a designer and developer, a microloan will do the trick.

- Cash advance. This loan takes a portion of your sales back as payment or requires you to pay a set fee in exchange for funds.

- Peer-to-peer loan. For e-commerce, these are marketplaces that offer third-party sellers a loan. For example, Amazon offers peer-to-peer loans to sellers on its platform as a way to help increase sales in the marketplace.

- Credit card. Whether it’s a personal card or business card, use this as a go-to for smaller purchases like the tools and software for shipping your products.

- Credit union. This is a member-owned cooperative that lets members borrow money as needed. Although they offer some of the same features as traditional banks, there are risks to using credit unions.

About 50% of small business owners went to their local bank in 2017 to apply for a loan. With the growth of fintech companies like Fundera and Avant, you also have the option to apply for loans online. Approval through these types of companies is much quicker than traditional banks —sometimes with loan approval taking just a few hours.

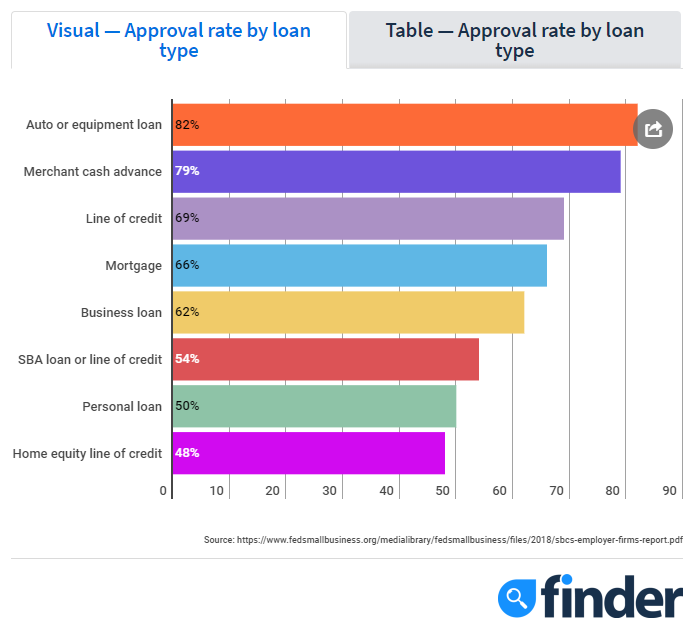

Depending on the type of loan you’re applying for, approval rates vary.

[Source]

As you can see, business loans have an average approval rate of 62%, while lines of credit have an approval rate of 69%. That’s not to say you’ll get the full amount you applied for, either. Often, the loan businesses get is lower than what they asked for. Keep this in mind when you create a budget for how you’ll spend your loan. Have a best-case scenario if you’re approved for the full amount and a worst-case scenario if you receive the minimum amount.

The type of loan you choose depends on how much debt you’re willing to carry and your ability to pay it back. There’s no sense applying for a $60,000 loan with a 25% interest rate if it means funneling your profits into debt repayment vs. reinvesting the funds into your business.

Also, keep in mind that if you’re just starting out, your initial loan might have to be a personal loan. As your business grows and has a consistent revenue stream and more credibility, it’ll be easier to take out a business loan. For example, an initial personal loan can be used to cover startup costs like inventory, packaging, and shipping. Once you’re set up and running, a business loan can help you expand your business by hiring a team or outsourcing storage and fulfillment.

Secure Funding to get Access to Experienced Resources

When you hear terms like angel investor or venture capital, the first things to come to mind are likely cloud-based software companies and not e-commerce stores. The truth is, there’s lots of untapped potential and resources in these channels when it comes to e-commerce. For example, venture capital investments made up $117.65 billion in funds invested in seed-stage deals globally in 2018. That’s a lot of money to work with considering investments are increasing year over year!

Funding relies on your ability to generate capital from external sources that believe in your products and overall business idea. Investors are easy to find and have different expectations for their investment. Examples of the types of funding you can choose from include:

- Crowdfunding. Use a platform like Kickstarter to raise funds with the help of many different small investors. Kickstarter is one of the most popular platforms for crowdfunding and helps you set up and track your campaigns. You don’t have to pay back the funds you raise or offer a stake in your business.

- Venture Capital (VC). This is a person or company with funds available to invest in new and emerging small businesses that have the potential to generate lots of revenue. VCs expect a return on their investment and will ask for equity in your business — somewhere in the neighborhood of 15-45%.

- Angel Investor. This is a person who uses their own money to fund small businesses. They expect a return on their investment and equity in your business. A popular platform to find investors is AngelList.

There isn’t an application process to receive funds; instead you have to pitch your idea or business to investors. If you’ve ever watched an episode of Shark Tank, then you know how intense the pitching process can be.

[Source]

For investors that require an eventual return on their investment, part ownership of the business, or both, there’s pressure for you to grow quickly and make lots of money. The good thing is most investors don’t leave you to your own devices to do this alone. In return for their investment, you get access to a wealth of knowledge to help you succeed.

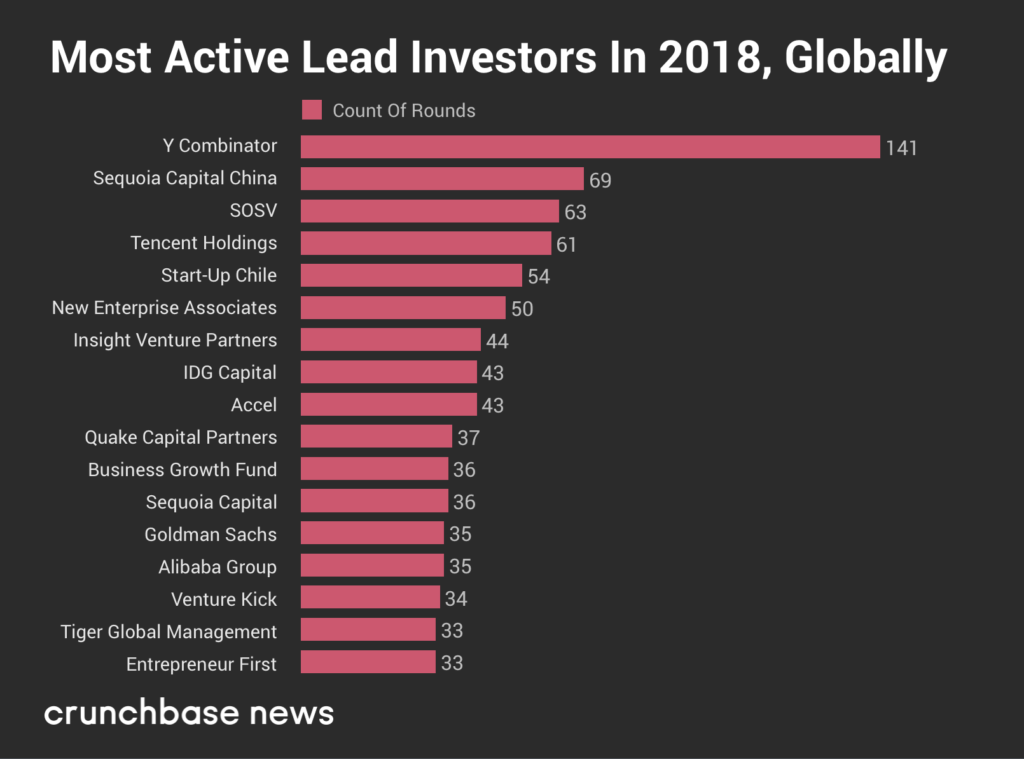

Take a look at this list of 2018 leading investors:

[Source]

Think about the wide network of connections each of these investors has acquired over the years. You, as a seller, can tap into this network to build your own list of business contacts to learn and get advice from.

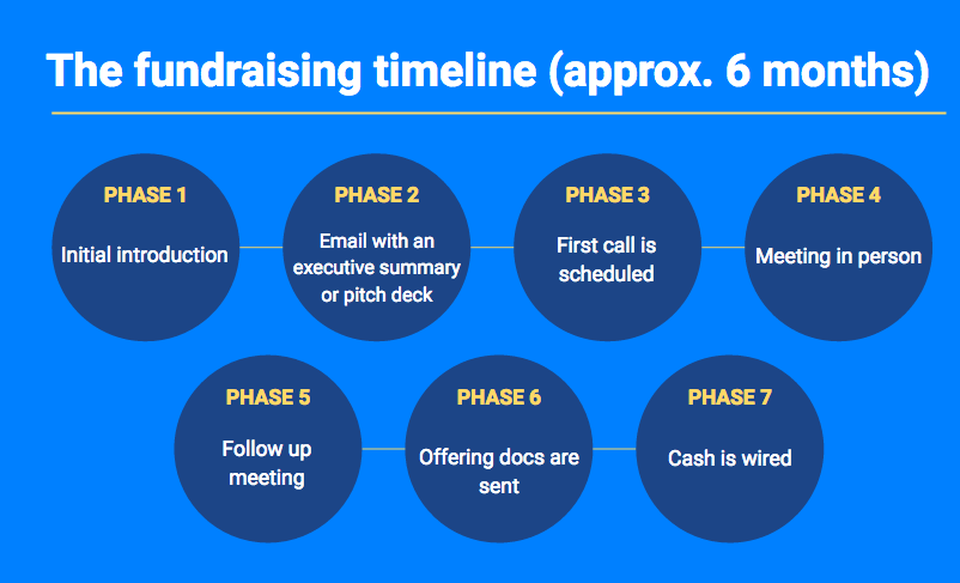

There’s one big downside to funding. Unlike business loans that can take anywhere from a few hours to a few days to process, securing investments takes longer:

[Source]

Choose this option if you aren’t cash strapped and have a healthy operating budget to carry you through until your funding comes through.

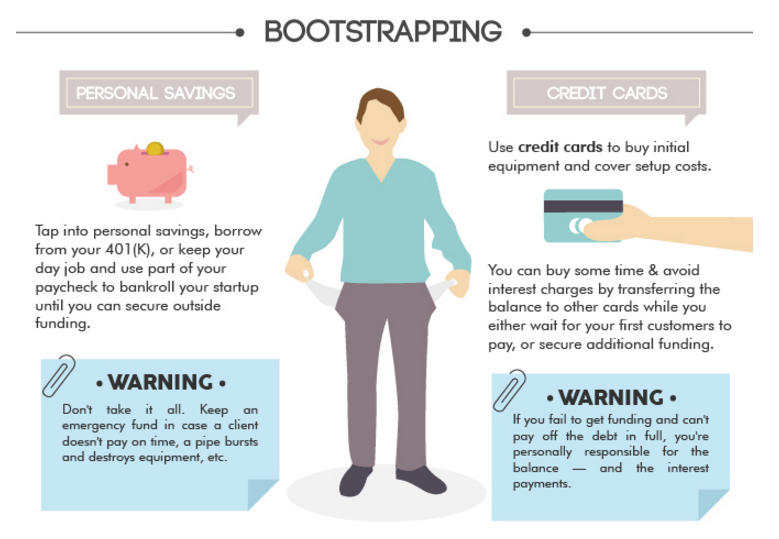

Use Bootstrapping to Unlock Creativity

Bootstrapping is one of the simplest ways to finance your small business. Unlike the other options that rely on other businesses or people to help you finance your small business, bootstrapping relies on you using your own money to get started. Brandon Ackroyd, founder at TigerMobiles and an angel investor, shares, “My top tip for raising money is: use your own money first. Far too many startups expect others to invest when they’ve injected zero of their own money into a business.”

[Source]

It might take a little longer to save up what you need but bootstrapping opens the door to creativity. If you don’t have stacks of money to throw at your business problems, you’re forced to think of less expensive options to find answers.

Let’s say you have a loyalty program and use it to improve customer retention and lower acquisition costs. If it’s only converting 5% of the customers who see it, there’s a problem. If you have over $100,000 in the bank, it might be tempting to make the reward more lucrative in the hopes that it’ll attract more customers. But there’s no guarantee this approach will even work.

Instead of using money to solve this problem, bootstrapped businesses might use a free tool like SurveyMonkey to survey customers, figure out what they want, and rebuild the program. All without spending much money. By pausing to get to the root cause of the problem, chances are your loyalty program will perform better and boost the lifetime value (LTV) of your loyal customers.

Use bootstrapping if you’re in the very early stages of your business. If you’re still in the idea stage or you only have a few products to sell, this option lets you test the market and research your audience before fully jumping in.

You can still ask for a loan or funding later on but at least with bootstrapping, you’ve taken the time to prove product/market fit, understand your customers, and confirm your financial needs. In fact, Brandon puts it this way, “I want to see founders who have the confidence to put their money where their mouth is,” he says. “Sweat equity is all well and good, but if you don’t know how to bootstrap and keep costs to a minimum, you’re going to turn off a lot of serious investors.”

How You Finance Your Small Business Determines Your Success

There are lots of benefits to each of the finance options above — like quick access to money and access to an experienced pool of resources — but there are risks as well. For example, with crowdfunding, someone might take your idea before you launch or you might miss out on funding because your pitch flopped.

The best way to start is to do your homework to figure out which option is best for you and your business and what steps you need to take:

- If you’re crowdfunding, figure out what legal protection you need to safeguard your idea before you launch your campaign.

- If you’re getting a loan, figure out how much debt you can carry comfortably.

- If you’re bootstrapping, figure out how long it’ll take you to save what you need to get started.

One final option to consider is grants. State and local governments set aside funds for small businesses — this is basically free money — so check to see what’s available to you before heading to the bank for a loan.